Calculated Pricing for Labor Items

Details

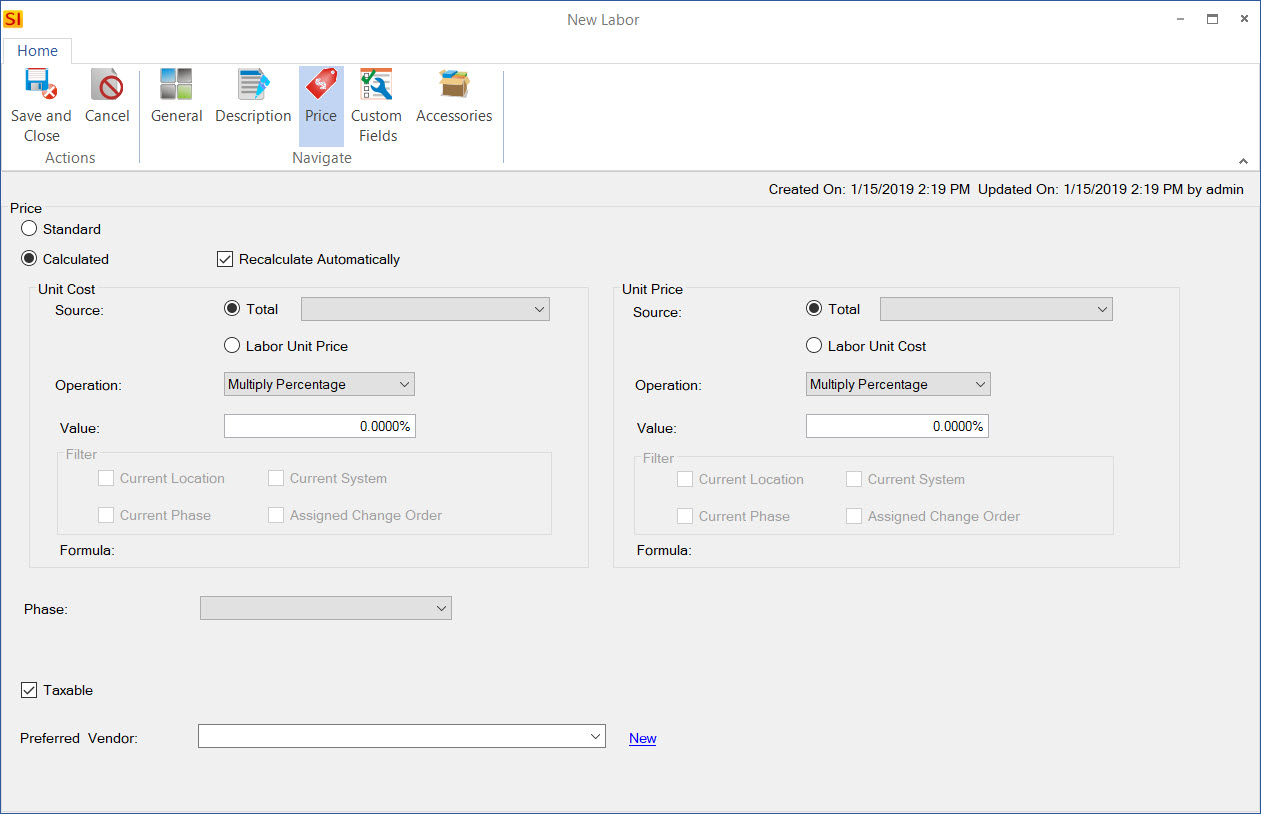

You have the option of creating a calculated price for Labor Items vs. a set price.

Calculated Labor Items can be used for shipping, per diems, or anything else that you want to account for that is not a "piece of equipment".

Rules

Existing Labor Items in your Catalog cannot be converted to a calculated price. Only new Labor Items being added can be set to be calculated.

Calculated Labor Items do not calculate off of each other, i.e. the price of other calculated items will not be used for other calculated items. This includes Calculated Products and Calculated Allowances.

No labor is applied to Calculated Labor Items. A Phase can be assigned to them but no labor hours.

Fields

There are a variety of options to set the value for the Unit Cost and Unit Price for a Calculated Labor Item.

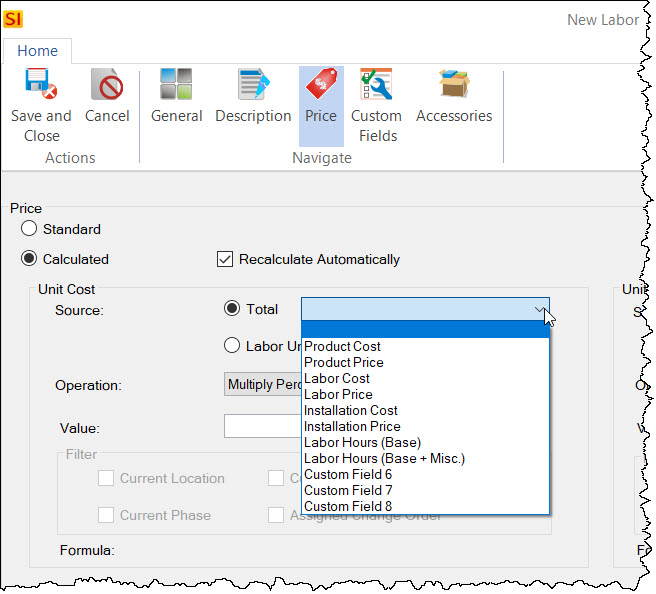

Source

First you choose your source field. This can be the Labor Unit Price or Labor Unit Cost or you can choose one of the following Total fields:

The "Recalculate Automatically" option is checked by default. This will automatically update the Unit Cost/Unit Price of the Labor Item within a Project when the value for the Source changes. If you do not have this box checked you can still manually recalculate the price for a Calculated Labor Item within a Project.

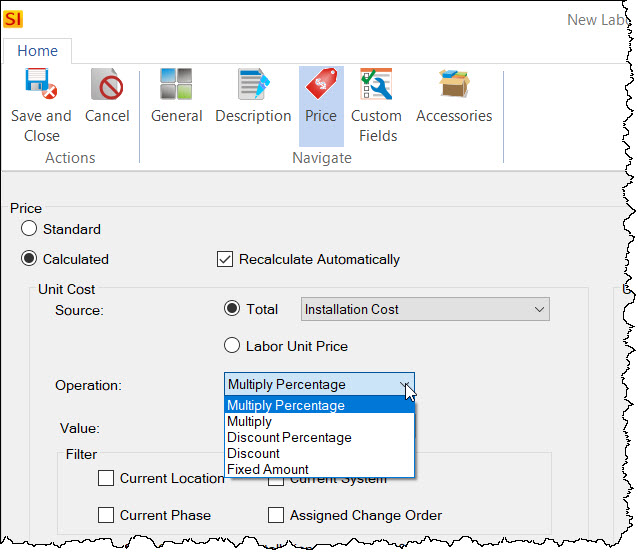

Operation

Next you choose an operation from the following list:

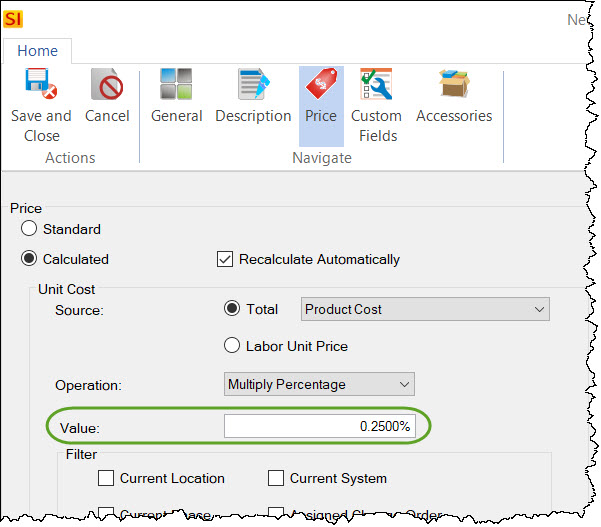

Value

Once you've chosen an operation you can then set a value. The value will either be a percentage or a decimal number based on the operation chosen:

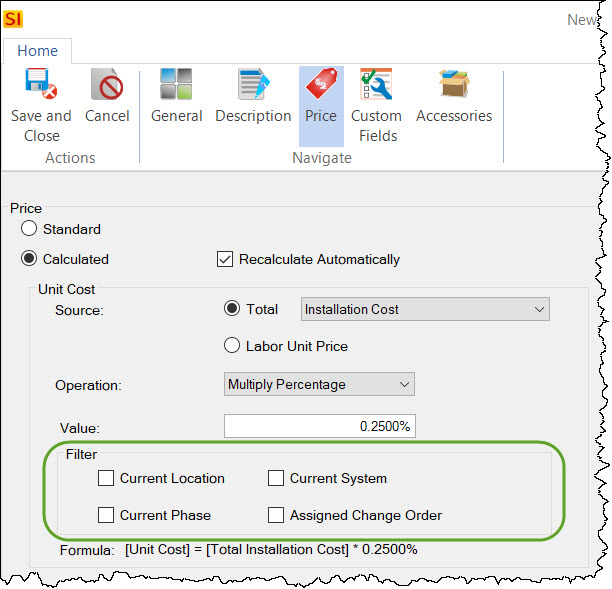

Filters

You have option of setting one or more of the following filters shown below:

If you do not choose a filter when using a "Total" Source, the Project total for that source will be used.

- © Copyright 2024 D-Tools